Quva’s Top 10 Data Providers for Alternative Investment Professionals

Gaining and maintaining a competitive advantage is critical for alternative investment professionals, here’s why…

For Venture Capital Fund Managers, identifying the fast-growing start-up/scale-up companies that fit your investment thesis before your competitors, will allow you to build key relationships at an early stage.

Ensuring the right companies and Founders are on your radar early means you can keep your pipeline in good shape, enabling you to deploy capital into the right companies at the right time.

Private Equity Fund Managers tend to deal with mature companies, so it’s critical to identify those that meet your investment strategy and have the potential to be transformed.

Whilst target companies can be introduced through long-standing relationships with corporate finance professionals, accountants, lawyers, accelerators and incubators, there is so much activity in the private markets sector that it’s critical to have a broad and robust direct deal origination strategy to complement those traditional intermediary channels.

Find companies where transactions can be invested at the right entry price, requires careful research and detailed market analysis and benchmarking capabilities.

For publicly traded companies, there is an array of information available for investment analysts to carry out detailed market research, critical analysis and accurate benchmarking. The data is publicly available, however, this is not the case for private companies. Very little information about these private companies is publicly available, making it difficult for venture capital and private equity investors to evaluate or benchmark the performance of target companies.

Tracking private market trends can be extremely complex, with so many new innovations across multiple sectors and geographies combined with macro and microeconomic drivers. However, unless Fund Managers, Investment Managers and Investment Analysts are able to maintain accurate, up-to-date market intelligence and insights, they run the risk of missing opportunities and letting other firms build a strong competitive advantage.

![]()

To help give you an advantage and get insights into the latest and most innovative startups before your competitors, we’ve compiled a list of our top 10 private company data providers.

Bloomberg offers data for investment professionals throughout the private equity fundraising journey - from opportunity prospecting, raising additional rounds, to creating exit strategies. Bloomberg provides analytics into private companies and their industries so PE investors can manage risk against return.

![]()

Beauhurst is an online platform that enables investment professionals to find the right companies and the right time. Beauhurst allows users to discover comparables, conduct due diligence and gain detailed information on every high-growth company and transaction in the UK.

![]()

Crunchbase is a platform which connects VCs and private equity fundraisers to innovative companies. Crunchbase’s private company data offering includes a directory of startups and investors from the US and Europe. Their venture capital data is used by over 55 million professionals each year to spot investment opportunities and generate revenue.

![]()

Pitchbook provides merger and acquisition (M&A) data on a global scale. For venture capitalists, Pitchbook’s data provides predictions about hot sectors and deals ahead of market competition. This makes the sourcing process more efficient and rewarding.

![]()

CB Insights is a data provider offering stock market data. The company’s analytics are used by tech startups to predict emerging trends, and by venture capitalists to identify successful startups ahead of competitors. With their venture capital data, CB Insights aims to remove the ‘three Gs’ from alternative investment decisions: Google searches, gut instinct and guys with MBAs.

![]()

Founded in 2000 and operational in 67 locations across Europe, North & South America, the Middle East, Africa, and Asia-Pacific, Mergermarket gives investment professionals a competitive advantage, delivering insights on deals 6-24 months before they become public knowledge.

![]()

Mattermark provides market and company data via a normalized API. Mattermark collects its data from millions of news articles and websites each day using machine learning, web crawlers, primary sources, and natural language processing. Mattermark’s company analytics enable PE investors and VCs to close deals in confidence.

![]()

Specter can provide insights into any company in the world. We gather 100+ data points and growth signals about every company. Whether it be financial information, news or real-time talent movements, Specter allows investment professionals to identify market trends before they become mainstream - staying ahead of the competition.

![]()

Privco provides investment professionals with access to private company financials, enabling you to streamline your research and make key decisions. Using proprietary mapping algorithms including machine learning technology and human QA engineering to vet data, PrivCo is able to provide always updated insights on the private company space in the U.S.

![]()

AngelList is a platform which connects venture capitalists to over 100,000 startups. AngelList’s proprietary data enables investors to funnel their capital into strong deals. The company’s data aims to make investing and managing portfolios more simple and efficient, so that venture capitalists can allocate resources effectively and maximize revenue.

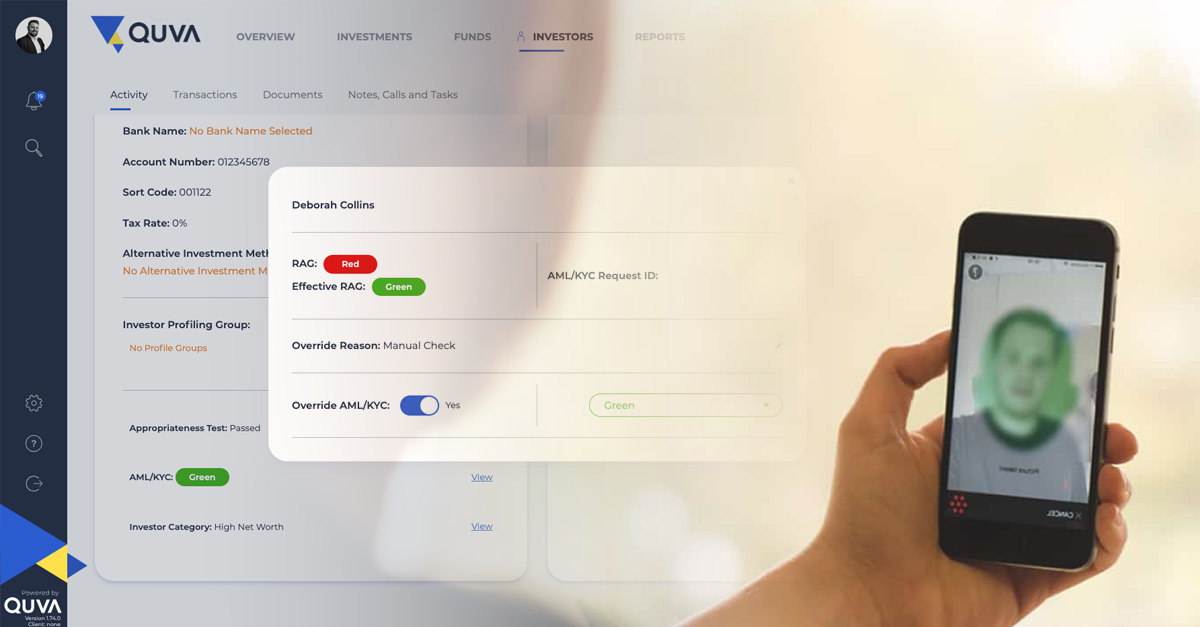

Now you’ve got the insights, put them to work – and that’s where Quva can help. We can help streamline your entire investment process from deal origination to realisation and exit, allowing you to focus on what’s most important – making those all-important investments.

Quva has been built as an API-first solution and can integrate with almost any existing solution or deal origination software, giving you one of the most powerful alternative investment solutions on the market.